how much federal tax is deducted from a paycheck in ma

With estimated taxes you need to pay taxes quarterly based on how much you expect to make over the course of the year. Median household income in 2020 was 67340.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

You are able to use our Massachusetts State Tax Calculator to calculate your total tax costs in the tax year 202223.

. Contacting the Department of. What Is The Federal Tax On 10000. This tax is paid.

For Medicare you both pay. For 2022 employees will pay 62 in Social Security on the. On the first 15000 each employee earns Massachusetts employers also pay unemployment insurance of between 094 and 1437.

Social security tax and medicare tax are two federal taxes deducted from your paycheck. Youll use Federal Form W-4 to calculate how much federal income tax to withhold from your employees pay. New employers pay 242 and new.

Adjusted gross income - Post-tax deductions Exemptions Taxable income. If you make 10000 a year living in the region of California USA you will be taxed 885. Federal income tax rates range from 10 up to a top marginal rate of 37.

Federal legislation may also require withholding for federal taxes on refunds received on or after January 1 1993. Jan 01 2020 when massachusetts income tax withheld is 500 or more by the 7th 15th 22nd and last day of a month pay over within 3 business days after that. Paycheck Deductions for 1000 Paycheck The amount withheld per paycheck is 4150 divided by 26 paychecks or 15962.

The total Social Security and Medicare taxes withheld. The social security tax is 62 percent of your total pay until you reach an annual income threshold. As of 2015 FICA taxes for Social Security take 62 percent of your salary up to 118500.

The federal income tax has seven tax rates for 2020. There are no income limits for Medicare tax so all covered wages are subject to Medicare tax. So the tax year 2022 will start from July 01 2021 to June 30 2022.

When you request a refund your retirement board will provide information on. The amount of federal and Massachusetts income tax withheld for the prior year. Your employer pays an additional 145 the employer part of the Medicare tax.

Your employer pays another 62 percent on your behalf. These amounts are paid by both employees and employers. In each paycheck 62 will be withheld.

Calculating your Massachusetts state income tax is similar to the steps we listed on our Federal paycheck. IR-2019-178 Get Ready for Taxes. The payment dates for Massachusetts estimated taxes are April.

Federal Paycheck Quick Facts. Our calculator has recently been updated to include both the latest Federal. Employees should complete this form when hired.

The Tax Withholding Estimator can help taxpayers with part-year employment estimate their income credits adjustments and deductions more accurately and check if they. Income Tax Calculator California. FICA taxes consist of Social Security and Medicare taxes.

How To Deduct Your Home Office On Your Taxes Forbes Advisor

Learn More About The Massachusetts State Tax Rate H R Block

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

6 Common Miscellaneous Expenses Examples Tax Deduction Tips For Small Businesses

How To Read Your Paycheck To Make Sure It S Correct Huffpost Life

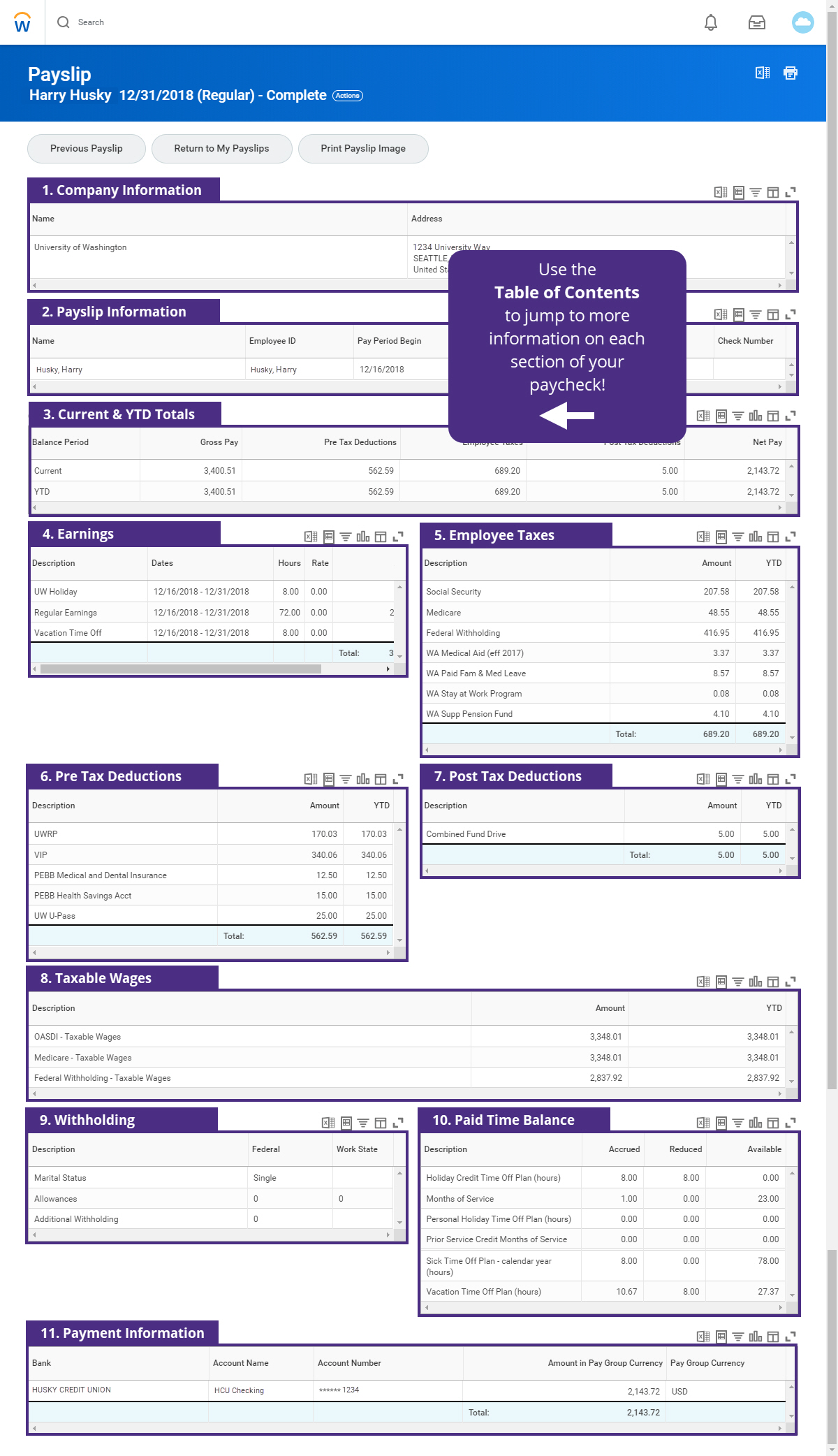

How To Read Your Payslip Integrated Service Center

How To Calculate Income Tax In Excel

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

How Much Federal Tax Is Withheld From A 300 Weekly Check From A Single Person With No Dependents Quora

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

Payroll And Tax Deductions Infographic Paycor Hr And Payroll Payroll Taxes Payroll Tax Deductions

2022 Federal State Payroll Tax Rates For Employers

:max_bytes(150000):strip_icc()/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Payroll And Tax Deductions Infographic Paycor Hr And Payroll Payroll Taxes Payroll Tax Deductions